On Feb. 28, The Supreme Court of the United States (SCOTUS) heard arguments for Biden v. Nebraska. The decision for this case has the ability to uproot President Biden’s federal student loan relief plan. Under the Biden administration’s program, individuals who make less than $125,000 per year are eligible for up to $20,000 in debt relief if they are a Pell Grant recipient or $10,000 in debt relief if they are not. If the justices rule in Nebraska’s favor, Biden’s program would be deemed unconstitutional and would not be put into effect.

Those that listened to the oral arguments may have noticed that the plaintiff’s primary reasoning was not what was expected, according to Assistant Professor of Political Science Ross Dardani, Ph.D. Dardani noted that “this case is definitely part of much broader trends that most people aren’t paying attention to that are also really important.” The trends alluded to by Dardani involve a concept known as standing. Standing refers to whether or not a person or entity can demonstrate significant harm has been done to them that would elicit legal action. The states– including Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina– that have sued the Biden administration are arguing that the program violates separation of powers because it was done without congressional approval and was the result of an executive action. The Biden administration justified the program using the HEROES Act, a law passed to provide emergency relief during the COVID-19 pandemic.

Historically, the Court would not have accepted a case such as this because the barrier for standing was much higher. Dardani stated that “what’s been happening in recent years with the Roberts Court, is that they’ve been more sympathetic to lowering the barriers to standing for these types of cases that involve attorneys generals of states who are attempting to challenge federal laws.” This is part of a broader, decades-long conservative legal movement to dismantle the administrative state and the practice of deferring to independent regulatory agencies.

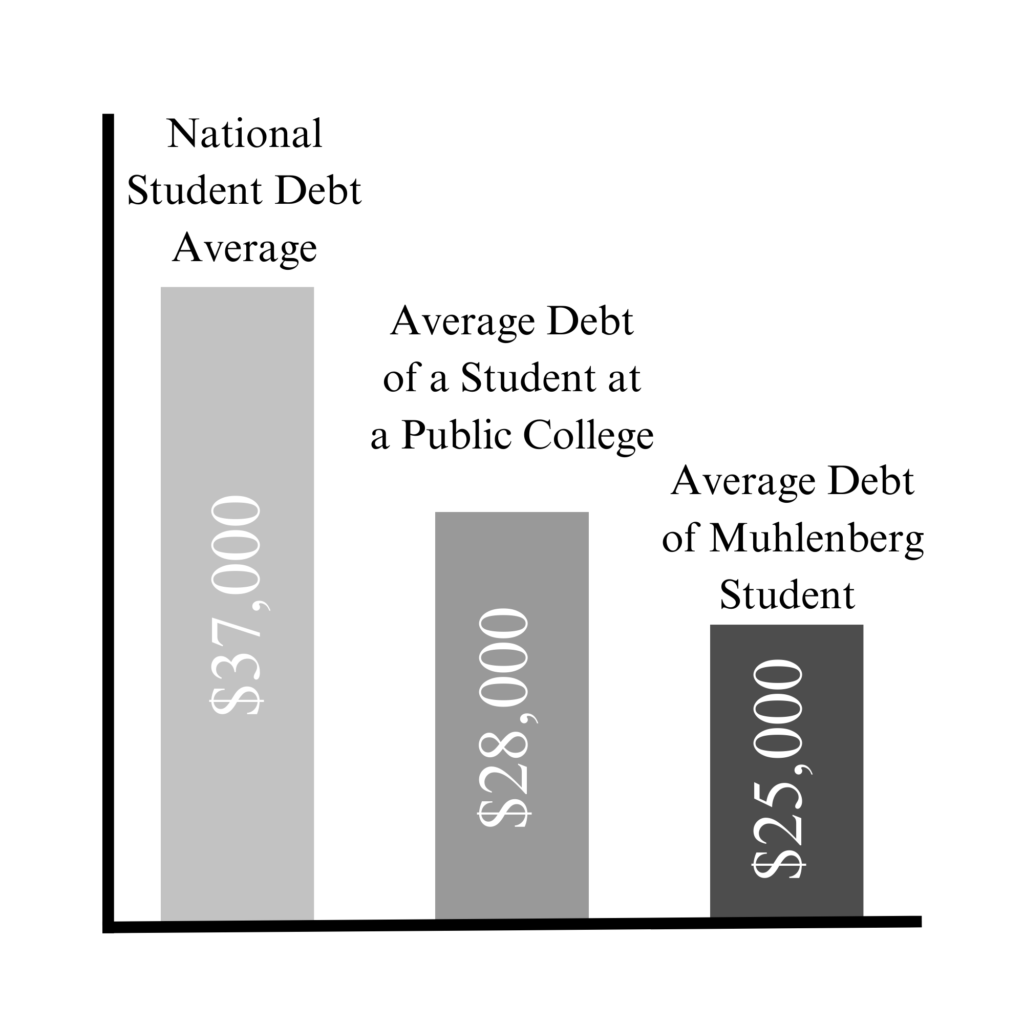

President Kathleen Harring, Ph.D., described the student body’s current relationship with debt saying, “Muhlenberg graduates average approximately $25,000 in federal student loan debt, which is lower than the national average of more than $37,000 and lower than the $28,000 average debt of students attending public institutions. Our alumni are getting jobs that set them up for success to make these payments and launch meaningful careers. The most recent federal student loan default rate for Muhlenberg alumni was 1.5 percent—also significantly lower than the national average.”

Director of Financial Aid and Associate Dean of Admissions Greg Mitton explained how Muhlenberg consults with students about their federal financial aid saying, “Before a student can take a federal loan they are required by federal mandate to complete a process called Entrance Counseling. This exercise introduces students to their rights and responsibilities regarding the Federal Student Loan program. This process is repeated at the time of graduation. This is called Exit Counseling. In this process students will learn that their Federal Loan Servicer is a vital component to loan repayment experience and the many options they have in terms of payment plans.”

Mitton continued noting, “In addition to their loan servicer, the Office of Financial Aid is always available to answer any questions students and alumni may have during or following their Muhlenberg experience. My staff and myself will spend countless hours in individual counseling sessions to help students make the best choice possible regarding the use of a Federal Student Loan.”

Harring added information about the College’s connection to the Pell Grant program, which is a federally funded program that provides need-based aid for undergraduates. “As a member of NAICU (National Association of Independent Colleges and Universities), Muhlenberg supports the organization’s efforts to lobby Congress to continue to increase and eventually double the Pell Grant maximum from $6,495 to $13,000… Pell Grant recipients continue to have more student-loan debt than their peers; they are twice as likely to have student loans than non-Pell-eligible students. Doubling the Pell Grant is one of the most effective ways that Congress can improve access to higher education and reduce its cost,” stated Harring.

So, the lingering question is: will I get my money? The likely answer is, no. It was reported that the Court’s conservative majority seemed unsympathetic to the defense’s argument. As of Apr. 3, an appeals court unpaused the student debt forgiveness process. So, currently, individuals can apply for relief. Whether or not the Supreme Court will deem the program constitutional will not be known until the summer. However, it is looking like the conservative supermajority will rule in favor of the plaintiffs.

Katie is a Media & Communication and Political Science double major in the class of 2024. When she's not working on the paper you can find her blasting Taylor Swift, reading Jane Austen, or crying over Little Women (2019).

This Court case is not about who owes what, or what someone can afford. It is simply about the right of the Executive to forgive contracted loans. I have long suggested since a college education benefits the student for a lifetime, the loan programs should be like a mortgage; longer payback terms and market rates (yes, with caps if that’s what the public wants).

PS. I think the above article was well done.